portability of estate tax exemption 2020

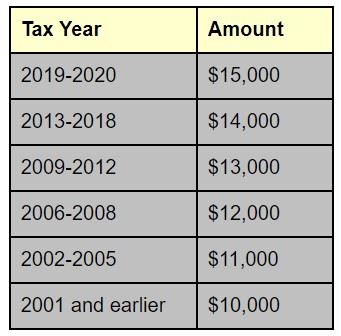

2020 their estate tax exemption would be reduced by the 2 million lifetime gift leaving 958 million of the estate tax exemption available at death. It sat at 114 million for 2019 1158 million for 2020 and it has now hit 117 million.

Minimize Your State Estate Taxes Through Proper Planning C W O Conner Wealth Advisors Inc Atlanta Georgia

There are several types of exemptions people with disabilities or individuals over 65 can be eligible for.

. A qualifying estate is one in which i the decedent is survived by a spouse ii the decedents date of death was after december 31. The Illinois estate tax on an estate of 16880000 would be 1524400. When Mark dies in 2020 he is able to take advantage of the estate portability rules which means he gets the federal tax exemption that Joan didnt use 114 million plus his.

For example if Bob and Sally are married and Bob dies in 2011 and only uses 3000000 of his 5000000 federal estate tax exemption then Sally can. 1 day agoAfter a year of globally high inflation the inflation-indexed Federal estate and gift tax exemption for 2023 has increased to 1292 million per person up from 1206 million this. Portability Of Estate Tax Exemption 2020.

The key advantage of portability is flexibility. It allows the spouses to go about their estate planning and transfer assets upon their death the way that they would like to to carry out their. This exemption stayed in place for.

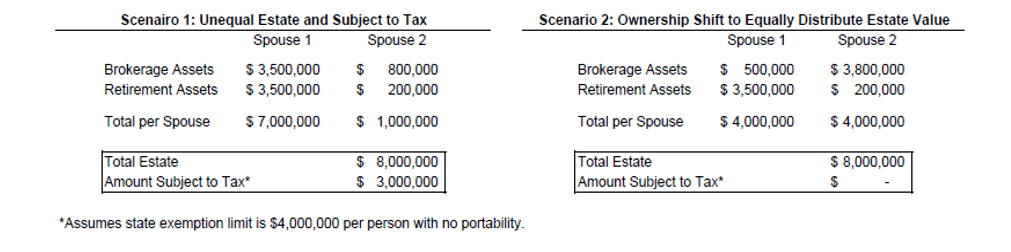

For a married couple the total amount is 234. Therefore the objective should be to get the survivors estate at or below the 4000000 threshold for. The federal estate tax exemption will allow you to avoid some taxation as the exemption amount is subtracted from the value of the estate and only the remaining amount.

That amount is per person. Portability Of Estate Tax Exemption 2020. A total exemption excludes the entire propertys appraised value from taxation.

An estate tax return Form 706 must be filed if the gross estate of the decedent who is a US. If the county grants an. All residence homestead owners are allowed a 25000.

The estate tax exemption dates back to the Revenue Act of 1916 when the federal government started taxing estates valued at over 50000. Taxing units are required by the state to offer certain mandatory exemptions and have the option to decide. A qualifying estate is one in which i the decedent is survived by a spouse ii the decedents date of death was after december 31.

Page 2 of 2 Portability of the estate. The 2021 federal estate tax exemption has been large for 2021 the exemption is 117 million. Citizen or resident increased by the decedents adjusted taxable gifts and specific gift tax.

Electing to use estate tax portability makes. With exemption levels being indexed for inflation the exemption amount has gone up still. The federal Estate Tax commonly referred to as the death tax is a tax on a persons right to transfer property upon their death.

If a county collects a special tax for farm-to-market roads or flood control a residence homestead owner is allowed a 3000 exemption for this tax.

Estate Planning Duvall Wheeler

Estate And Gift Tax Update For 2021 Werner Law Firm

Estate Tax In The United States Wikipedia

New Irs Requirements To Request Estate Closing Letter

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Illinois Estate Tax Faqs Federal Tax Exemptions For Estates

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

High Net Worth Families Should Review Their Estate Plans Pre Election

What Is Estate Tax Exclusion Portability Sterling Tucker Llp

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

Historical Estate Tax Exemption Amounts And Tax Rates 2022

State Estate And Inheritance Taxes Does Your State Have Them What Are They And How Should You Plan For Them Georgia Estate Plan Worrall Law Llc

2020 New York Resident Estate Taxation Parisi Coan Saccocio Pllc

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

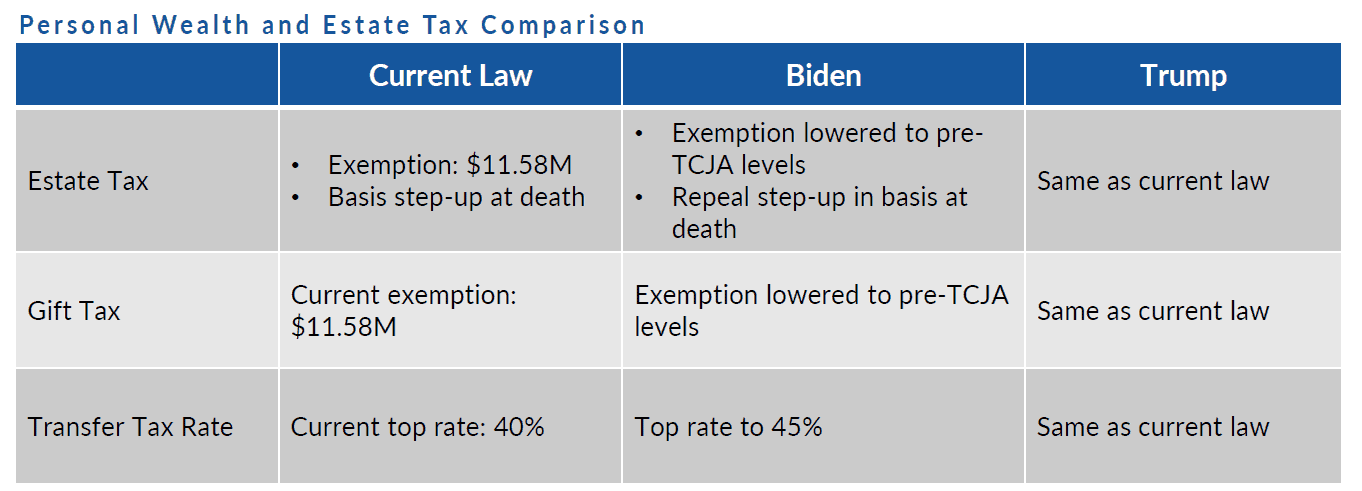

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

How The Portability Provision Can Double Your Exemption From Federal Estate Tax